I’ve handpicked the best Today’s Hot Deals for your shopping pleasure! If you love to shop the after-Christmas Clearance sales, we want to help you stretch your dollars and find what you need.

Bookmark this page and check back often. If there are items you are looking for and you want to find the very best price, send us an email to morewithlesstodayteam [at]gmail.com, and our team of deal-spotters will do the research and email you back with what we find! We love to help our readers. We all know prices go up and down quickly so double-check the websites for the most up-to-date prices and availability.

Double-check prices and delivery times- they change frequently. I’ll be updating this post often so keep checking back for the best online shopping deals.

We have affiliate relationships which means we may earn a small referral commission at no additional cost to you if you shop using our links. As an Amazon Associate, I earn from qualifying purchases.

Navigate This Article

Today’s Hot Deals for After Christmas Clearance

Amazon

Find amazing deals on overstocked items, markdowns, clearance products, and more at Amazon Warehouse and Outlet! Whether you are looking for kitchen appliances, electronics, clothing, books, or anything else, you can save up to 60% or more on thousands of discounted products. Browse by category and discover the best bargains on your favorite brands and products. Don’t miss this opportunity to save, shop, and get the most out of your online shopping experience.

Bed Bath and Beyond

If you are looking for great deals on home essentials, you should check out the Bed Bath and Beyond clearance section. You can find up to 75% off on items from every department, including bedding, baths, kitchens, furniture, rugs, and more. Whether you need to refresh your bedroom, update your bathroom, or revamp your living room, you can save big on quality products from top brands.

Best Buy

Are you looking for amazing deals on electronics, appliances, and more? Then you should check out my Best Buy clearance finds. I have scoured the Best Buy Outlet and found some of the best bargains on top-rated products from brands like Samsung, LG, Sony, and HP. Whether you need a new laptop, TV, camera, or smartwatch, you can save up to 50% or more on these clearance items. But hurry, these deals won’t last long.

Chico’s

Chico’s Clearance is the best place to find incredible deals on women’s clothing. You can save up to 75% off on jackets, tops, pants, jeans, dresses, skirts, and accessories from Chico’s. Whether you need a new outfit for work, casual, or special occasions, you can shop by category and size and discover the latest styles and trends at unbeatable prices.

Dick’s

If you are a sports enthusiast, you don’t want to miss the Dick’s Sporting Goods clearance section. You can find up to 75% off on sports apparel, footwear, gear, and more from top brands like Nike, adidas, Under Armour, and Patagonia. Whether you need new equipment for your favorite sport, clothing for your workout, or accessories for your outdoor adventure, you can shop by category and size and score amazing deals on quality products.

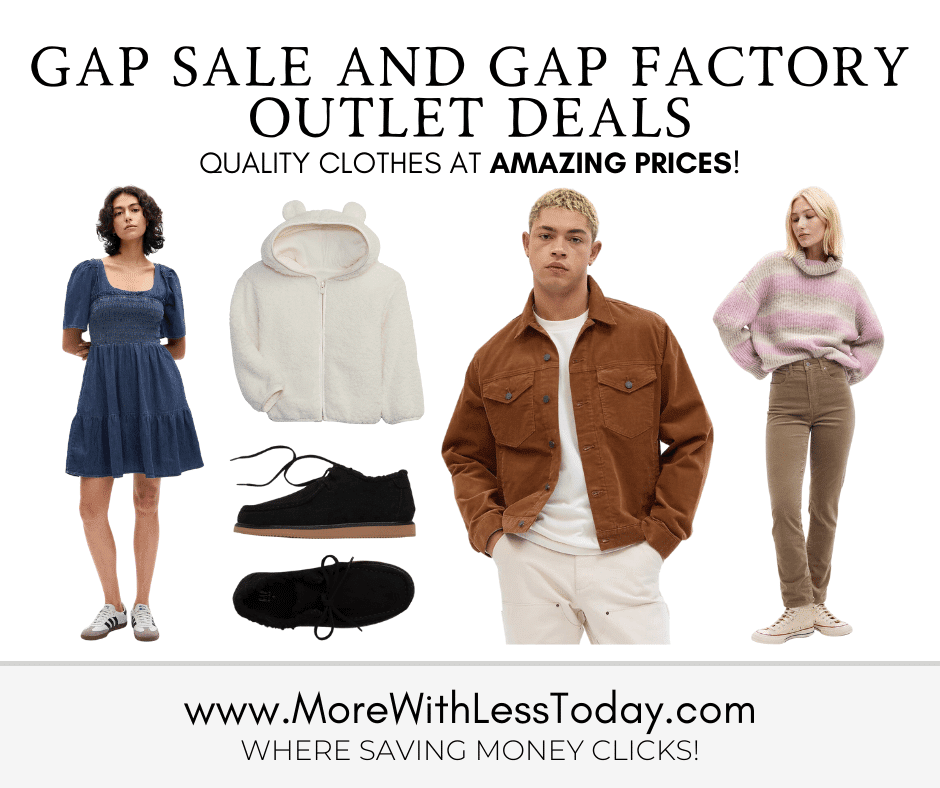

GAP

Are you looking for the best deals on GAP clothing and accessories? If so, you’re in luck! GAP has a huge online sale where you can save up to 50% off on select styles. Whether you need a cozy sweater, a chic dress, or a trendy pair of jeans, you’ll find something to suit your taste and budget at GAP.

But wait, there’s more! If you want to save even more money, you can also check out the GAP Factory Outlet, where you can find amazing discounts on GAP’s quality products. GAP Factory Outlet offers clearance items, exclusive deals, and extra savings on your favorite GAP items. You can shop online or find a GAP Factory Outlet near you.

HSN

If you love shopping for great deals on quality products, you’ll love HSN Clearance. HSN Clearance is the ultimate destination for bargain hunters, where you can find amazing prices on everything from fashion, jewelry, beauty, home, electronics, and more. You can save up to 60% off on thousands of items from top brands and designers.

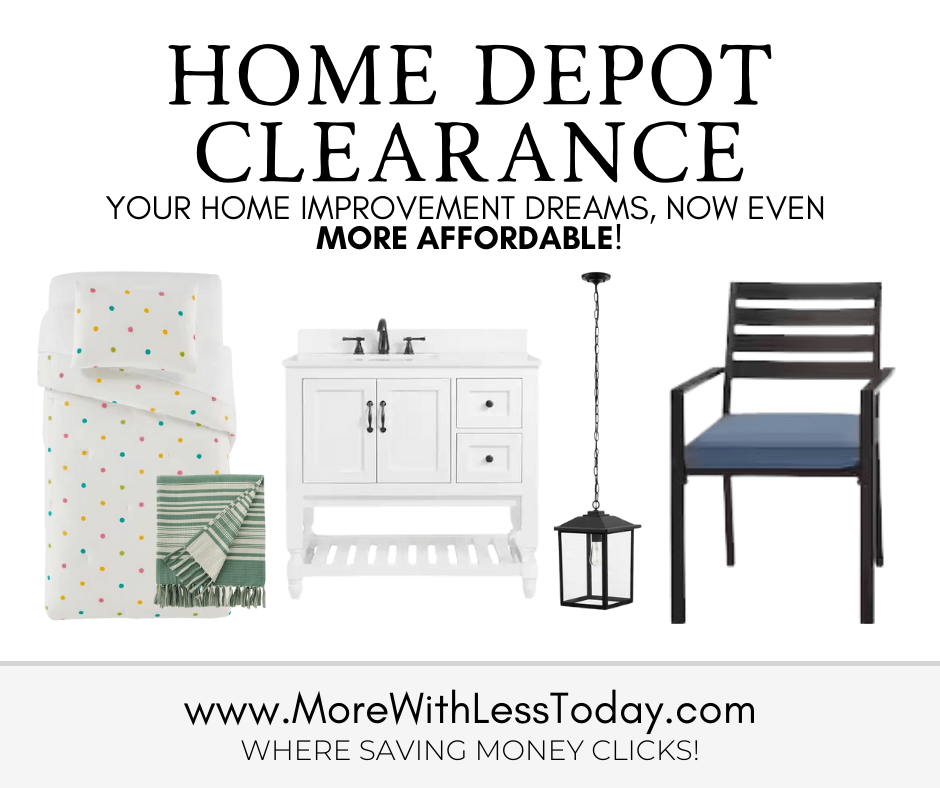

Home Depot

Looking for the best deals on home improvement products, you’ll want to check out Home Depot Clearance. Home Depot Clearance is where you can find incredible discounts on everything from tools, hardware, lighting, flooring, appliances, and more. You can save up to 75% on select items from trusted brands and manufacturers. But act fast, because these deals are only available while supplies last!

Kohl’s

Get amazing deals on quality products from Kohl’s clearance sale. You can save up to 70% on thousands of items, from clothing and accessories to home goods and electronics. Whether you need a new outfit, a gift for someone special, or a fresh update for your living space, you will find it at Kohl’s clearance.

LOFT

Are you ready to refresh your wardrobe with stylish and affordable pieces? Then you will love LOFT clearance, where you can find amazing discounts on women’s clothing and accessories. Whether you are looking for cozy sweaters, chic dresses, flattering jeans, or trendy tops, you will discover a variety of options to suit your taste and budget at LOFT clearance. Don’t wait, shop LOFT clearance today and save up to 60% on your favorite styles!

Lululemon

Do you love Lululemon’s high-quality and stylish activewear, but not the high prices? Then you will be thrilled to discover Lululemon’s We Made Too Much section, where you can find incredible savings on selected items. Whether you are into running, training, yoga, or just lounging, you will find something to suit your needs and preferences at We Made Too Much.

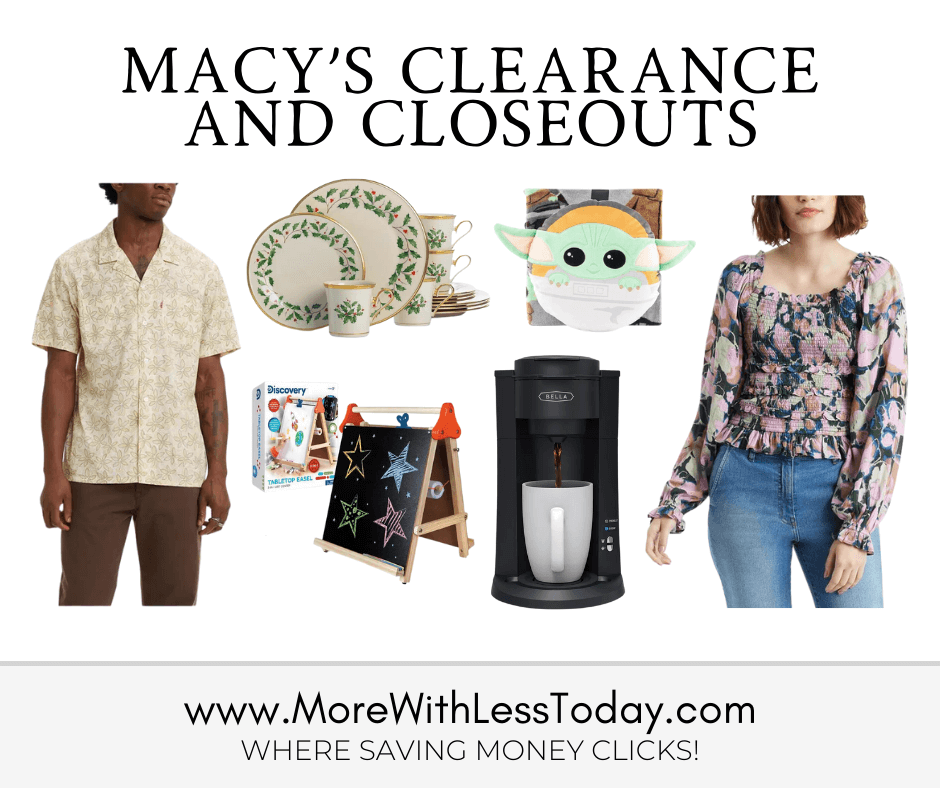

Macy’s

Are you looking for the best deals on fashion, beauty, and home products? Then you will love Macy’s clearance, where you can find amazing discounts on thousands of items. Whether you need a new outfit, a gift for someone special, or a fresh update for your home, you will find it at Macy’s clearance.

Nike

Are you a fan of Nike’s high-performance and stylish products? Then you will love Nike clearance, where you can find amazing deals on shoes, clothing, and accessories. Whether you are into running, training, yoga, or just casual wear, you will find something to suit your needs and preferences at Nike clearance.

If you’re looking for amazing deals on clothing and accessories for the whole family, you’ll love the clearance collection at Old Navy. You can find great discounts on a wide range of styles, from hoodies and t-shirts to dresses and footed one-pieces.

QVC

Loking for amazing bargains on quality products from your favorite brands? Then you’ll love the QVC clearance section, where you can find incredible deals on everything from fashion and beauty to electronics and home decor. Whether you’re shopping for yourself or for a gift, you can save up to 70% off the original QVC price on select items. Don’t miss this chance to shop the QVC clearance section and get more of what you love for less!

Walmart

Looking for the best deals on a wide variety of products? Then you’ll love the Walmart clearance section! You can find up to more than 60% off on items from categories such as home, fashion, tech, toys, seasonal decor, and more. Don’t miss this opportunity to shop the Walmart clearance section and get more value for your dollar!

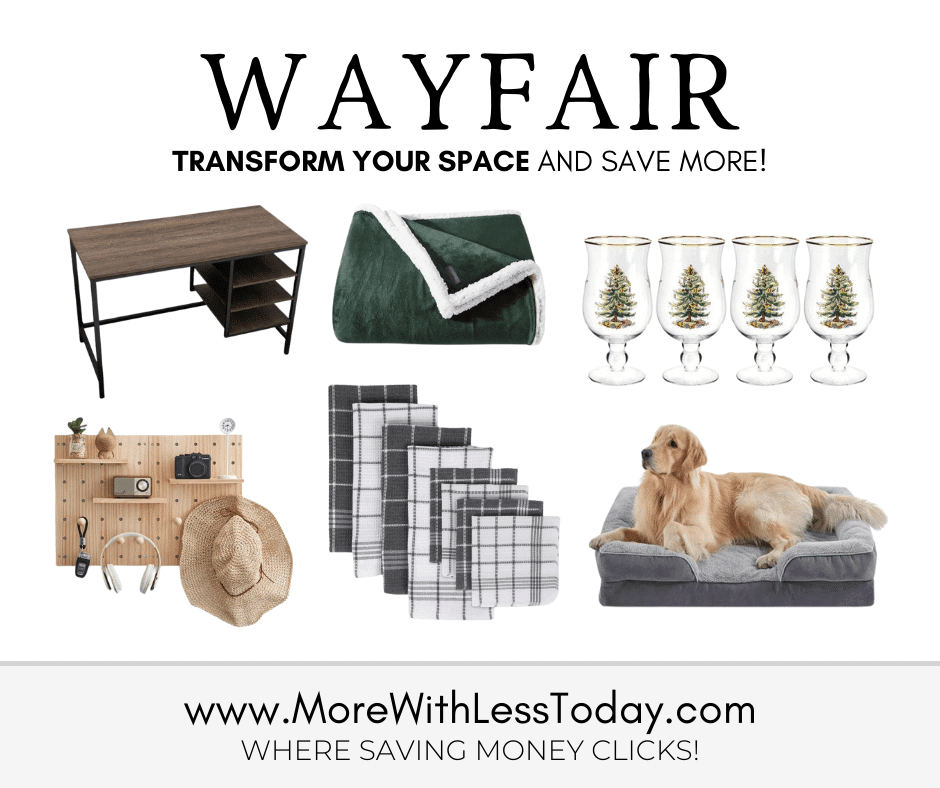

Wayfair

Want the best prices on furniture, decor, bedding, and more? Look no further than this list of the Wayfair clearance deals! You can save up to 50% on thousands of items from every category, from wall art and accent pillows to dining chairs and bookcases. Don’t miss this opportunity to shop the Wayfair clearance deals and get more of what you love for less!

Don’t forget to share this post with your friends and loved ones. If you are on social media, I would love to connect with you on Facebook, Instagram, Pinterest, or Twitter. Just click on the links to visit my profile. Leave a message and I will follow you back!

Leave a Reply